Furniture Expenses In Accounting . Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Furniture and fixtures are larger items of movable equipment that are used. what is the definition of ff&e? what are furniture and fixtures? Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. Ff&e is important because it represents a significant portion of a company’s assets. depreciation of furniture and fittings on the balance sheet is mostly undertaken according to the rules and regulations put. furniture expenses in accounting: furniture and fixtures definition. Ffe are assets that depreciate over their useful life, usually three years or more, and include office furniture, fixtures, and. Depreciation allows you to expense this gradual loss of value over the asset’s useful life. why is ff&e important? Furniture and fixtures wear out over time.

from www.coursesidekick.com

why is ff&e important? Ff&e is important because it represents a significant portion of a company’s assets. what is the definition of ff&e? Furniture and fixtures wear out over time. furniture expenses in accounting: Depreciation allows you to expense this gradual loss of value over the asset’s useful life. furniture and fixtures definition. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Ffe are assets that depreciate over their useful life, usually three years or more, and include office furniture, fixtures, and. Furniture and fixtures are larger items of movable equipment that are used.

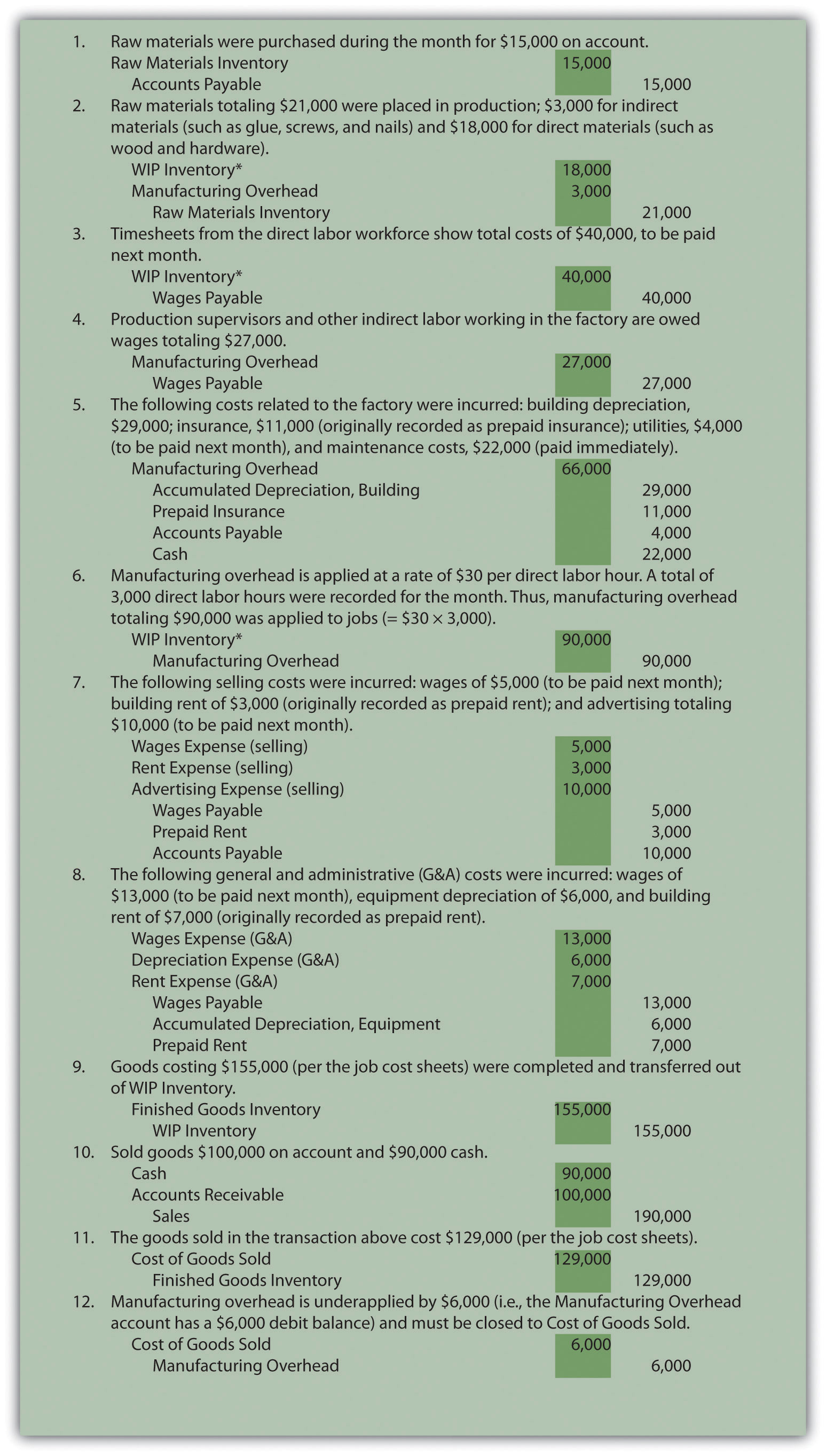

Example Summary of Cost Flows at Custom Furniture Company Accounting

Furniture Expenses In Accounting why is ff&e important? what is the definition of ff&e? what are furniture and fixtures? why is ff&e important? Depreciation allows you to expense this gradual loss of value over the asset’s useful life. furniture expenses in accounting: depreciation of furniture and fittings on the balance sheet is mostly undertaken according to the rules and regulations put. Furniture and fixtures are larger items of movable equipment that are used. Furniture and fixtures wear out over time. furniture and fixtures definition. Ffe are assets that depreciate over their useful life, usually three years or more, and include office furniture, fixtures, and. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Ff&e is important because it represents a significant portion of a company’s assets. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit.

From saylordotorg.github.io

What Is Managerial Accounting? Furniture Expenses In Accounting depreciation of furniture and fittings on the balance sheet is mostly undertaken according to the rules and regulations put. what is the definition of ff&e? Ff&e is important because it represents a significant portion of a company’s assets. furniture and fixtures definition. what are furniture and fixtures? Furniture and fixtures wear out over time. Office furniture. Furniture Expenses In Accounting.

From www.bench.co

Expense Trackers The Top 6 Tools For Small Businesses Bench Accounting Furniture Expenses In Accounting what are furniture and fixtures? Ff&e is important because it represents a significant portion of a company’s assets. Depreciation allows you to expense this gradual loss of value over the asset’s useful life. depreciation of furniture and fittings on the balance sheet is mostly undertaken according to the rules and regulations put. Office furniture is classified as a. Furniture Expenses In Accounting.

From exoeteknu.blob.core.windows.net

Furniture Store Accounts at Cheryl Butcher blog Furniture Expenses In Accounting Furniture and fixtures wear out over time. Ffe are assets that depreciate over their useful life, usually three years or more, and include office furniture, fixtures, and. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Ff&e is important because it represents a significant portion of a company’s assets. why is ff&e important? Office furniture is classified. Furniture Expenses In Accounting.

From www.chegg.com

Solved Required a. List each account title under the element Furniture Expenses In Accounting Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Furniture and fixtures wear out over time. what is the definition of ff&e? Depreciation allows you to expense this gradual loss of value over the asset’s useful life. Ffe are assets that depreciate over their useful life, usually three years or more, and include office furniture, fixtures, and.. Furniture Expenses In Accounting.

From www.geeksforgeeks.org

& Expenditure Account Accounting Treatment Furniture Expenses In Accounting Furniture and fixtures wear out over time. Ffe are assets that depreciate over their useful life, usually three years or more, and include office furniture, fixtures, and. what are furniture and fixtures? what is the definition of ff&e? why is ff&e important? Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization. Furniture Expenses In Accounting.

From worksheetfullbreloque.z22.web.core.windows.net

Types Of Entertainment Expenses Furniture Expenses In Accounting Ff&e is important because it represents a significant portion of a company’s assets. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. furniture expenses in accounting: furniture and fixtures definition. Furniture and fixtures wear out over time. Ffe are assets that depreciate over their useful life, usually three years or more,. Furniture Expenses In Accounting.

From www.youtube.com

Accounting Expenses Explained with Examples YouTube Furniture Expenses In Accounting what are furniture and fixtures? why is ff&e important? furniture and fixtures definition. Ff&e is important because it represents a significant portion of a company’s assets. Furniture and fixtures are larger items of movable equipment that are used. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. what is. Furniture Expenses In Accounting.

From saylordotorg.github.io

Accrual Accounting Furniture Expenses In Accounting depreciation of furniture and fittings on the balance sheet is mostly undertaken according to the rules and regulations put. what is the definition of ff&e? furniture expenses in accounting: why is ff&e important? Furniture and fixtures are larger items of movable equipment that are used. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because:. Furniture Expenses In Accounting.

From yourgymwiki.blogspot.com

Furniture, fixtures and equipment (accounting) Furniture Expenses In Accounting what are furniture and fixtures? depreciation of furniture and fittings on the balance sheet is mostly undertaken according to the rules and regulations put. Furniture and fixtures wear out over time. Ff&e is important because it represents a significant portion of a company’s assets. what is the definition of ff&e? why is ff&e important? furniture. Furniture Expenses In Accounting.

From vencru.com

Free excel accounting templates and bookkeeping spreadsheet Vencru Furniture Expenses In Accounting what is the definition of ff&e? Depreciation allows you to expense this gradual loss of value over the asset’s useful life. Furniture and fixtures are larger items of movable equipment that are used. furniture expenses in accounting: furniture and fixtures definition. why is ff&e important? Furniture and fixtures wear out over time. depreciation of furniture. Furniture Expenses In Accounting.

From accountinghowto.com

What is an Expense? Accounting Student Guide Accounting How To Furniture Expenses In Accounting Ff&e is important because it represents a significant portion of a company’s assets. furniture and fixtures definition. what are furniture and fixtures? depreciation of furniture and fittings on the balance sheet is mostly undertaken according to the rules and regulations put. why is ff&e important? furniture expenses in accounting: Understanding “furniture and fixtures in accounting,”. Furniture Expenses In Accounting.

From dxolwjtpy.blob.core.windows.net

Furniture Expenses For Rental Property at Tony Matthews blog Furniture Expenses In Accounting Ffe are assets that depreciate over their useful life, usually three years or more, and include office furniture, fixtures, and. Furniture and fixtures are larger items of movable equipment that are used. why is ff&e important? Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. depreciation of furniture and fittings on. Furniture Expenses In Accounting.

From db-excel.com

Examples Of Double Entry Bookkeeping — Furniture Expenses In Accounting Furniture and fixtures wear out over time. furniture and fixtures definition. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. what is the definition of ff&e? why is ff&e important? what are furniture and fixtures? Depreciation allows you to expense this gradual loss of value over the asset’s useful. Furniture Expenses In Accounting.

From accountinglessonsonline.blogspot.com

Accounting Free Lessons Online Illustration of the Statement of Furniture Expenses In Accounting Ff&e is important because it represents a significant portion of a company’s assets. furniture and fixtures definition. Furniture and fixtures wear out over time. furniture expenses in accounting: depreciation of furniture and fittings on the balance sheet is mostly undertaken according to the rules and regulations put. Office furniture is classified as a fixed asset if its. Furniture Expenses In Accounting.

From www.youtube.com

Journal Entries FURNITURE ENTRY ACCOUNTING ASSIGNMENT YouTube Furniture Expenses In Accounting what is the definition of ff&e? Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. furniture expenses in accounting: depreciation of furniture and fittings on the balance sheet is mostly undertaken according to the rules and regulations put. furniture and fixtures definition. Depreciation allows you to expense this gradual. Furniture Expenses In Accounting.

From www.coursesidekick.com

Example Summary of Cost Flows at Custom Furniture Company Accounting Furniture Expenses In Accounting Ff&e is important because it represents a significant portion of a company’s assets. Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. Furniture and fixtures wear out over time. furniture and fixtures definition. Depreciation allows you to expense this gradual loss of value over the asset’s useful life. what is the. Furniture Expenses In Accounting.

From msofficegeek.com

ReadyToUse Cost Sheet Template MSOfficeGeek Furniture Expenses In Accounting Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Depreciation allows you to expense this gradual loss of value over the asset’s useful life. Ff&e is important because it represents a significant portion of a company’s assets. depreciation of furniture and fittings on the balance sheet is mostly undertaken according to the rules and regulations put. Ffe. Furniture Expenses In Accounting.

From spscc.pressbooks.pub

LO 4.7 Use a 10column worksheet (optional step in the accounting cycle Furniture Expenses In Accounting Office furniture is classified as a fixed asset if its cost exceeds the company's capitalization limit. why is ff&e important? Ffe are assets that depreciate over their useful life, usually three years or more, and include office furniture, fixtures, and. what is the definition of ff&e? furniture expenses in accounting: furniture and fixtures definition. Furniture and. Furniture Expenses In Accounting.